When it comes paying for the damages made to your car because of any accident, it’s collision coverage that offers you the very initial layer of protection. Many of us believe that we are never going to dump our vehicle on another, or will never get involved in an accident.

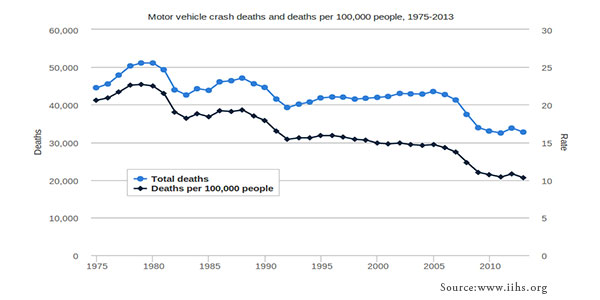

Yet, as per statistics provided by Association for Safe International Road Travel (ASIRT), in the U.S., over 37,000 people die in road crashes each year, and nearly 8,000 people are killed in car accidents involving drivers ages 16-20. However, the good sign is, though the U.S. population has been growing steadily since 1975, the rate of deaths caused due to crashes has declined by more than half.

Nevertheless, If your vehicle is relatively new or worth a couple thousands dollars more than the average ones, and you’ve a history of reckless driving, you should have a collision coverage in place.

How does collision coverage protect you?

Collision coverage serves you basically in three ways:- Pays to recover the damage if you cause the accident: If you wreck your own vehicle, the cost to repair it will be borne out by your insurer. However, if the repair cost is more than the market price of the vehicle, they will pay to replace it based on the market price.

- Pays to recover the damage if someone else causes the accident: Your insurer will pay for your loss and then reach out to the insurer of the at fault for reimbursement.

- Pays to recover damages caused by circumstances other than the above ones: If you don’t have comprehensive coverage to protect against vandalism, theft, acts of nature, etc., you can typically claim for such losses under collision coverage. Again, collision coverage can protect against damages from hit-and-run accidents. However, using collision coverage under such circumstances may raise your rates.

Blog Category